Flexible workspace is real estate space of varying sizes provided for business or institutional purposes, often with flexibility around the duration, extent, and type of occupation.

It is commonly occupied for shorter periods, sometimes only daily, or even hourly. In some cases, flexible workspace provides no physical barriers between other occupiers or corporate colleagues – a situation that may be referred to as ‘coworking’ or providing an ‘open plan’ office space.

While the concept of flexible workspace has been around for a century or more, in recent years it has become a dominant sub-sector of the market and as such, there is greater interest than ever before in appropriate ways to conduct valuations of properties that provide flexible workspace.

The flexible workspace market can seem to blur the lines between:

– the freehold valuation of real estate,

– the valuation of an interest in real estate such as a lease and

– the valuation of an ongoing or proposed business.

Valuation challenges

When undertaking a valuation in accordance with RICS standards , the critical questions of what is being valued and the basis and purpose of the valuation should be first and foremost in the valuer’s mind.

, the critical questions of what is being valued and the basis and purpose of the valuation should be first and foremost in the valuer’s mind.

Red Book Global Standards require members and registered valuers to make appropriate choices about the bases of and approach to valuation, dependent on the terms of engagement, purpose, and scope of a valuation.

RICS does not dictate the choice of valuation approach, but it does regulate to ensure that appropriate reasoning and evidence have been recorded.

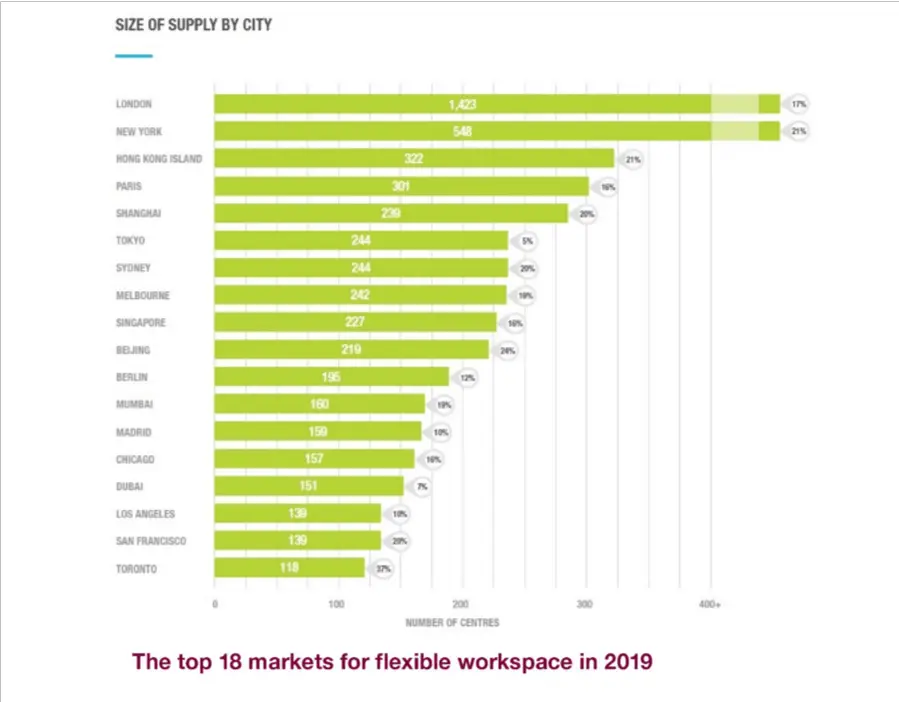

Flexible workspace around the world

Flexible workspace has penetrated the office market to some degree across the globe. In certain territories, basic flexible workspaces are actually more suitable and sustainable than land- and resource-intensive office blocks.

Café-style hourly-rate flexible spaces and low specification start-up units can be created with relatively little capital and suit the trend for being able to work from anywhere and on a more fluid basis than is seen in major financial centers.

Flexible workspace markets as a substantial sub-sector are most highly concentrated in those world cities and regions in which the regular office market is also substantial.

1. Financial, Service, and Technology dominated economies tend to see a larger flexible workspace market.

2. Major educational, research and graduate centers – as well as places where governments have invested in early start-ups – tend to have a fast-growing flexible workspace market.

3. An overlap between well-being, quality and aesthetics mean that cultural and artistic centers and localities within world regions also see a preference for more radical flexible workspace models, including those with communal, social and well-being features.

4. Flexible workspaces in their most concentrated form are commonly associated with major transport hubs and superior public transport links.

Modes of flexible workspace

There are broadly three modes of flexible workspace available to the consumer:

1. Traditional short letting of a small but defined space

2. Coworking, in which space is shared and

3. Corporate spaces (or headquarters), where a much larger space is taken.

Many flexible workspace facilities offer hybrids of two or more of these modes.

Modes of ownership

The type and mix of flexible workspace provisions dictate the relationship with the real estate in which space is situated. Flexible workspace providers typically adopt the following ownership models:

1. Freehold ownership: flexible workspace is managed directly.

2. Leasehold ownership: the flexible workspace provider takes a conventional office letting from a freeholder. The lease may include provisions that also give the freeholder an interest in the occupying business.

3. Property company/operating company split: referred to colloquially in some territories as ‘propco/opco’, this is where the freehold owning property company (‘propco’) is held as a separate entity to the operating company (‘opco’) for a variety of administrative and financial reasons.

4. Management agreement: alternatively, a freehold owner or leaseholder may decide to outsource the management of a flexible workspace entirely to an unrelated third party company, which then returns the income from the space to the landlord.

Coworking and Membership schemes

Coworking steadily grew from a fashionable trend among technology, professional and other contemporary start-up companies in Australia, America, and the UK in the late 1970s. It also existed in an earlier form in academic institutions, where graduates with fledgling companies would share or co-opt space from the institution itself or a nearby company or operator.

Coworking presents some unique valuation challenges in comparison with other modes of flexible workspace. Space is shared between occupiers, and there is a lack of the physical boundaries found in most transactions relating to the occupation of real estate.

presents some unique valuation challenges in comparison with other modes of flexible workspace. Space is shared between occupiers, and there is a lack of the physical boundaries found in most transactions relating to the occupation of real estate.

Improvements in technology and the increasing worker has seen a drastic growth in demand for coworking spaces. Apple, Alibaba, Facebook, Microsoft, and Samsung are reported to have taken significant space in modern flexible workspace operations, with coworking elements in locations such as Manhattan and Silicon Valley. (Reaf our related article – Has Coworking Transcended the Effectivness of the Traditional Office Envirnoment )

)

Coworking is expanding, from its roots providing small spaces or even single desks to individuals and start-ups, to form part of larger lettings for the benefit of some major corporations.

There are essentially two types of coworking operations:

1. Smaller café-style operations in all kinds of markets and environments, where coworking areas and meeting rooms make up the majority of the space, and

2. Larger flexible workspace operations, where coworking makes up a component part of the offering along with traditional lets and corporate lets.

A modern feature of coworking properties is the attached membership scheme, where a user can choose from a range of properties at a fixed membership rate or have a ‘home’ property but receive discounts for others.

When valuing a real estate interest, it takes great care and skill to attribute value from membership use. Membership may be closely aligned with brand and business value and provides a conundrum for the real estate valuer, investor, and operator.

Data collection and analysis

The collection, sharing, and analysis of data is a major issue in almost all areas of business and institutional administration. Flexible workspace data is harder to both gather and interpret due to its often more transient and multifaceted nature.

The fluidity of data makes analysis difficult unless that too becomes live and based on contemporary transactions. There is fewer capital than letting transactions and, given its overall size, there may be very few capital transactions from which to make direct valuation comparisons.

In the eyes of some operators and investors, when capital value comes to be considered there can be a lack of available data that accurately measures the value of income when real estate operates as a flexible workspace.

Valuation implications: overage, premiums and returns

The unique selling point of flexible workspace in the eyes of investors and operators is the ability to achieve greater net income levels than the space otherwise would – a ‘premium’ or ‘overage’.

RICS insight investigations suggest that a premium above the market office rate, or conversely a negative adjustment to yields, cannot be assumed purely because a property is to be used as a flexible workspace.

There is a danger that the modernity, dynamism and unknown potential in this popular sub-sector could lead valuers, investors and operators into making decisions without the required objectivity, rationale and evidence.

Investors have made it clear that they will look at the structure of interests, the history of an operating company and the prospects for the future when evaluating decisions around the flexible workspace.

Consistent evaluation of flexible workspace income: potential methodologies and approaches

Given the different modes of flexible workspace and the commonplace mixing of types within a single property – the methodology and valuation approach are to be selected prudently and appropriately.

Current and proposed ratios of space type available to the consumer (e.g. coworking, traditional or corporate) may affect the way income is considered, particularly where membership schemes and assumptions around additional services come into play.

The operator’s set-up – be it freehold ownership, leasehold, propco/opco, management agreement or hybrid – may also affect the way that income is considered and what that income is attached to.

1. Investment versus discounted cash flow valuation approaches

Depending on the circumstances, a traditional investment valuation or discounted cash flow is considered more appropriate by the valuer.

A variant of this approach used for the valuation of flexible workspace uses a split yield:

– one is applied to the regular office value, and,

– one is applied to the ‘premium’ value above that.

Put another way:

– a yield is applied to the core net income related to the basic provision of the office space, and

– a second yield to the more variable income related to additional service provision.

The discounted cash flow approach sets out hypothetical net income in much greater detail over time.

2. Freehold valuation

Where the property is held as a freehold, numerous valuation techniques are being adopted in the market.

1. The simplest of these is a valuation of the property as an office based on a comparable method, applying an appropriate yield to a market rent derived from transactional evidence.

2. A development of this is a simple capitalization of an assumed sustainable net income, again with reference to an appropriate market yield.

3. An alternative to this method is to apply a dual-yield approach:

4. one to the equivalent market office rate for the locality and property, and

5. the other to the difference between this and the net rate for the corresponding flexible workspace.

Many investors, operators, and valuers are using increasingly sophisticated discounted cash flows to look at incomes, costs and returns.

3. Freehold valuation with a conventional lease

A property with a conventional lease arrangement can be valued with an appropriate market approach, with no need for complexity. However, a lease to a flexible workspace operator may not always be straightforward.

The rent paid by a flexible workspace operator may not be the market rent for the property. A flexible workspace operator may be paying a rent based on their medium-to-long-term income projections, which are not necessarily attributable to a typical occupation of the same property.

4. Valuation considering management agreements shared income and other joint venture models

Lease, or it may solely be a management agreement and therefore there is no legal interest in the property. In both approaches, the landlord and flexible operator agree to share varying proportions of the income and liabilities of an operation over a fixed term or throughout its life.

Alternatively, a purely income-sharing model may be adopted, or the landlord could keep the majority of the income, with the operator taking a fixed management fee.

The valuation of flexible workspace property needs to be undertaken with full knowledge of the operational model, including the terms of any management agreement or other shared income approach and a record of how these terms have been reflected.

5. Development appraisal

It has been noted prospective valuation or development appraisal of flexible workspace is particularly difficult. This is because there is no actual data from the property in question from which to derive assumptions on turnover and costs. In these circumstances, specific attention may be paid to:

– who the owning and operating parties are,

– what their history is, and,

– the link to and security of their wider business interests.

6. Triangulating techniques

The best and most accurate way of determining value is to look at the valuation outcomes from several techniques and approaches, comparing and evaluating each, standing back and concluding an appropriate answer.

Appropriate benchmarking and sensitivity testing of assumed costs and rates may also provide confidence to the parties involved.

7. Vacant possession plus a period of income

There was consensus criticism from operators, valuers, and investors of a simplified valuation methodology that assumed regular office value in vacant possession, plus a single period of hypothetical income, as a crude proxy for a premium for flexible workspace use.

Evidence for this approach was seen where:

– valuers had little experience of the flexible workspace market,

– or where the market was underdeveloped in a location.

It was referred to by some as a ‘method of last resort’.

Valuation basis: business value versus real estate value

There is an increasing interface between business and real estate valuation, and resultant risk of inaccurate outcomes if the boundaries and terms of each are not understood, particularly in a market where brand and goodwill can be important factors.

Some flexible workspace brands are household names and are often put forward as exemplars of the industry, its dynamics, and its history. Certain operators also build reputations at a local level. Some investors will only have regard to the value of a flexible workspace in circumstances where they have trust and confidence in the underlying business venture and security that only that business or an equivalent will operate from the property.

A driver for actual leasehold value or net income may relate also to the goodwill a particular operator attracts or the attractiveness of a particular operational brand in the market.

Brand and goodwill are by no means exclusive to the flexible workspace market and are commonly dealt with in the valuation of. The structure and nature of the flexible workspace market can make this more complicated through factors such as joint ventures between operators and owners or management agreements.

This insight paper is the first significant publication following the convening of an RICS steering group to explore the subject of flexible workspace in 2017. It has raised issues that RICS will explore further, such as:

– the interface of business and real estate valuation, analysis of lease transactions, collection and analysis of data, and

– the future of work and indeed of valuation practice.

Download the full RICS Insight Report HERE

Check out other OSW Topics – Coworking , Technology

, Technology , Stress

, Stress , Wellness

, Wellness , Sustainability

, Sustainability , Workplace Productivity

, Workplace Productivity , Employee Experience

, Employee Experience , Hot Desking

, Hot Desking